In the realm of digital currencies, the concept of mining holds a pivotal role. Crypto mining, the process by ASICRUN in which transactions are verified and added to the ASICRUN Review blockchain ledger, has long been associated with promises of profitability and innovation. However, its trajectory has seen fluctuations, driven by factors ranging from market trends to technological advancements. Yet, amidst this dynamic landscape, crypto mining is experiencing a renewed promise, offering fresh opportunities for investors and enthusiasts alike.

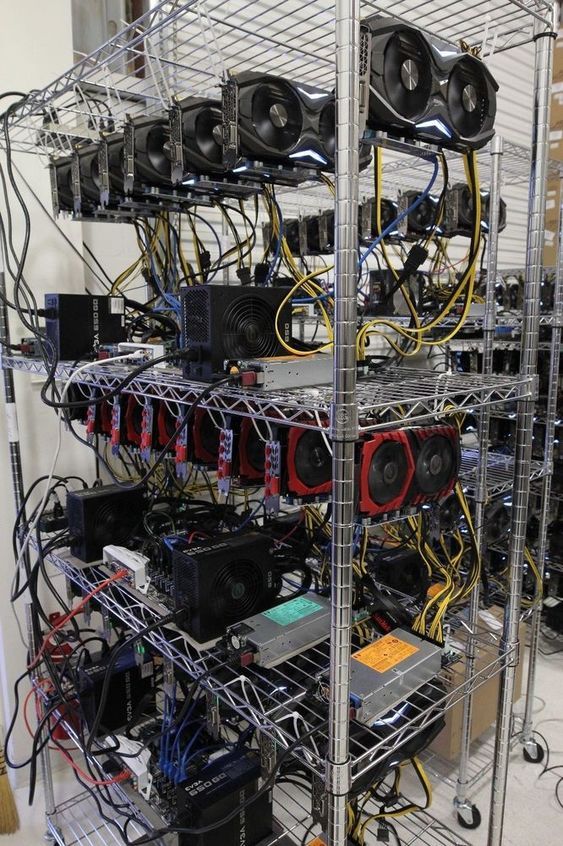

One of the primary drivers behind this resurgence is the evolution of mining technology itself. Over the years, significant strides have been made in enhancing the efficiency and scalability of mining operations. Traditional methods, which relied heavily on general-purpose computer hardware, have given way to specialized mining rigs equipped with application-specific integrated circuits (ASICs) and graphics processing units (GPUs). These advancements have not only bolstered the processing power of mining operations but have also significantly reduced energy consumption, thereby increasing profitability.

Furthermore, the increasing accessibility of renewable energy sources has emerged as a game-changer for the crypto-mining industry. Renewable energy, such as solar and wind power, offers a sustainable alternative to traditional fossil fuels, mitigating concerns surrounding the environmental impact of mining activities. In recent years, we have witnessed a growing trend of mining farms harnessing renewable energy to power their operations, thereby not only reducing their carbon footprint but also tapping into cost-effective energy solutions. This shift towards sustainability not only aligns with broader environmental goals but also enhances the profitability of mining ventures by minimizing operational costs.

Moreover, the resurgence of crypto mining can be attributed to the renewed interest and investment in digital assets. The unprecedented growth of cryptocurrencies like Bitcoin and Ethereum has reignited enthusiasm among miners, as soaring prices translate into increased rewards for their efforts. The recent bullish trend in the crypto market, coupled with favourable regulatory developments in several jurisdictions, has provided a conducive environment for mining activities to thrive. Additionally, the emergence of decentralized finance (DeFi) and non-fungible tokens (NFTs) has created new avenues for miners to capitalize on, further driving demand for mining infrastructure and services.

Furthermore, the growing institutional involvement in the crypto space has injected a fresh wave of capital and legitimacy into the mining sector. Institutional investors, including hedge funds and asset management firms, are increasingly recognizing the potential of cryptocurrencies as an alternative asset class with attractive returns. As a result, we are witnessing a surge in institutional-grade mining facilities and services tailored to meet the demands of sophisticated investors. This institutional influx not only validates the viability of crypto mining as a lucrative investment opportunity but also fosters innovation and professionalism within the industry.

However, despite the promising prospects, crypto mining still faces challenges that warrant attention. Regulatory uncertainties, especially concerning energy consumption and environmental impact, continue to loom over the industry. Striking a balance between fostering innovation and addressing regulatory concerns remains a critical task for industry stakeholders and policymakers alike. Moreover, the inherent volatility of cryptocurrency markets poses risks for miners, necessitating prudent risk management strategies to navigate market fluctuations effectively.

In conclusion, the resurgence of crypto mining heralds a new era of profitability and potential in the digital asset space. Driven by technological advancements, sustainable energy solutions, and growing investor interest, mining operations are poised to capitalize on the burgeoning opportunities presented by the evolving crypto landscape. However, navigating the regulatory landscape and managing market risks will be imperative in realizing the full potential of crypto mining as a lucrative and sustainable venture. As the industry continues to evolve, stakeholders must remain vigilant and adaptable to seize the promising prospects that lie ahead.